Tax Credits For Your Clients

There’s never been a better time for your small business clients to start up a retirement plan for their employees and for themselves.

Under the SECURE Act the setup and administration costs paid by a small business employer can now be basically cut in half for the first three years. How is that possible? The SECURE Act increased the small employer tax credit for new plans up to $5000 per year for the first three plan years (more if auto-enroll and auto-deferral are added).

Eligibility for the credit is limited to employers meeting the following requirements:

- 100 or fewer employees receiving at least $5,000 in compensation for the preceding year, and

- At least one plan participant was a non-highly compensated employee (NHCE), and

- In the three tax years before the first year eligible for the credit, the employees weren’t substantially the same employees who received contributions or accrued benefits in another plan sponsored by the employer, a member of a controlled group which includes that employer, or a predecessor of either.

Eligible employer plans for purposes of the credit include:

- Profit sharing/401k plans under 401(a)

- Annuity plans under 403(a)

- Simplified employee pension plans under 408k

- Simple retirement accounts under 408(p)

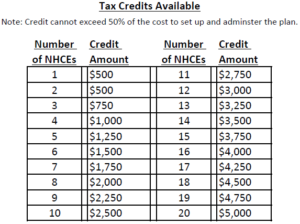

The tax credit equals the greater of (1) $500 or (2) the lesser of (a) $250 for each non-highly-compensated employee who is eligible to participate in the plan or (b) $5,000 per year, but cannot exceed 50% of the cost to set up and administer the plan. The credit is applicable for each of the first three years of the plan.

Following is a chart to help guide you: