Taking The Emotion OUT Of Investing

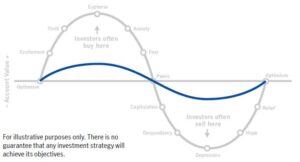

It’s natural to feel a roller coaster of emotions as the stock market rises and falls. After all, you’re investing money in the market to save for your future.

Reducing the emotional extremes when investing

- Your motivation – You chose your existing investments because you believe they’ll help you attain your long-term goals. Unless this belief has changed, there’s no reason to consider changing your investment strategy.

- Time horizon – When do you expect to retire, 5, 10, 20, or even 30 years from now? Your existing investments have potentially years to recover from a market downturn before you’ll need the money.

- Timing the market – No one can predict with 100% certainty when the market will go up or down. If you choose to change your investment strategy during a market decline, you then have to figure out the best time to change it back—something even financial professionals find challenging to do. If you don’t time it right, you could miss the market rebound, making it even harder to make progress on your goals.

- Dollar cost averaging – When the market fluctuates, so does the price of your investments. Making regular contributions to your 401(k) helps average out the highs and lows over time, which can help your personal, long-term return on investment. This investment strategy is known as dollar cost averaging.1

1Dollar cost averaging does not guarantee a profit or protect against a loss. Systematic investing involves continuous investment in securities, regardless of price-level fluctuation. Participants should consider their resources to continue the strategy over the long term.

For complete information about a particular investment option, please read the fund prospectus. You should carefully consider the objectives, risks, charges, and expenses before investing. The prospectus contains this and other important information about the investment option and investment company. Please read the prospectus carefully before you invest or send money. Prospectuses may only be available in English. There is no guarantee that any investment strategy will meet its objectives. Past performance does not guarantee future results. It is your responsibility to select and monitor your investment options to meet your retirement objectives. You should review your investment strategy at least annually. You may also want to consult your own independent investment or tax advisor or legal counsel. The content of this document is for general information only and is believed to be accurate and reliable as of the posting date, but may be subject to change. It is not intended to provide investment, tax, plan design, or legal advice (unless otherwise indicated). Please consult your own independent advisor as to any investment, tax, or legal statements made herein. Article and data source: John Hancock 2022