Ten Things You Can Do If You’re Feeling Inflation’s Pinch

Here Are Tips To Help Lessen Inflation’s Impact On Your Wallet

- Budget Basics – Don’t have a budget? Now’s the time to make one. And if you already have one, it may be time to reexamine it. Do your spending habits align with your true priorities? Can you cut back anywhere?

- Don’t Fall Into a Debt Trap – When your bills are on the rise, you may want to reach for your credit card. Unfortunately, debt is going to get more expensive as the Federal Reserve raises rates in an effort to combat inflation. Prioritize paying off debt with the highest interest rates first.

- Energy Efficiency – Making your home more energy-efficient can help keep your bills in check. Check windows and doors for leaks, make the switch to energy-saving light bulbs, and unplug chargers when not in use. Also make sure to regularly clean and replace filters and consider investing in a programmable thermostat.

- Save Some Green on Gas – When it comes to saving at the pump, start with your own habits—keep up with your car’s maintenance, stick to the speed limit, and be strategic about trips. Use apps such as GasBuddy or AAA to find the cheapest price nearby or look for stations that offer a discount when you pay in cash. Many grocery-store loyalty programs and warehouse-club memberships award discounts as well.

- Are You Still Watching? – Now is a great time to reevaluate streaming services, subscriptions, and memberships. Are you using them enough to justify the cost? Do the same thing with phone, internet, and insurance providers; you may be able to switch to a cheaper alternative or negotiate a cheaper rate.

- Supermarket Savings – If you’re looking to save on groceries, start by planning meals around what you already have. Use coupons, shop midweek when prices drop, compare prices, choose store brands, and stick to your list. Take advantage of sales on canned goods and frozen (or freezable) foods that keep for a while.

- Shop Smart – Coupon websites offer discounts for many online purchases. Before buying new, check Craigslist, Facebook Marketplace, and thrift stores. Warehouse stores often have even more savings: great deals on auto purchases, insurance, HVAC systems, and home furnishings.

- Save the Luxuries for Later – Many of us are itching to indulge in a vacation after two years of a pandemic, but it may be a good time to rethink it. Vacations, large purchases, and extra luxuries may need to take a back seat; if it’s not immediately necessary, you may want to wait for a better price down the road.

- Don’t Neglect Your Piggy Bank – You may be tempted to forsake putting a little money away each month, but it’s important to have a safety net in place—because the unexpected is getting more expensive, too.

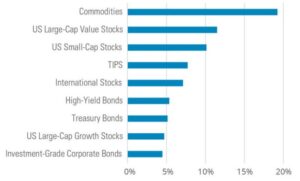

- Put Your Money to Work – While your money may currently have less purchasing power, choosing investments with the potential to keep pace with inflation may be a wise strategy (see chart). Even if you can’t afford to invest much now, the power of compounding can turn small amounts into large amounts over time. Keeping this perspective and playing the long game has historically paid off for investors.1

1Past performance does not guarantee future results. Indices are unmanaged and not available for direct investment. See below for representative index definitions. For illustrative purposes only. Note: Historical data unavailable for some asset classes. Rising core CPI periods, which do not include food or energy prices, defined as increases of about 1% or more. Eight time periods shown in chart are: 1973-1975, 1977-1980, 1983-1984, 1987-1991, 1999-2001, 2003-2006, 2010-2012, 2020-2021. Article and data source: Hartford Funds as of 12/31/21.